FC131Post War Boom and Bust (1920-29)

The illusion of prosperity

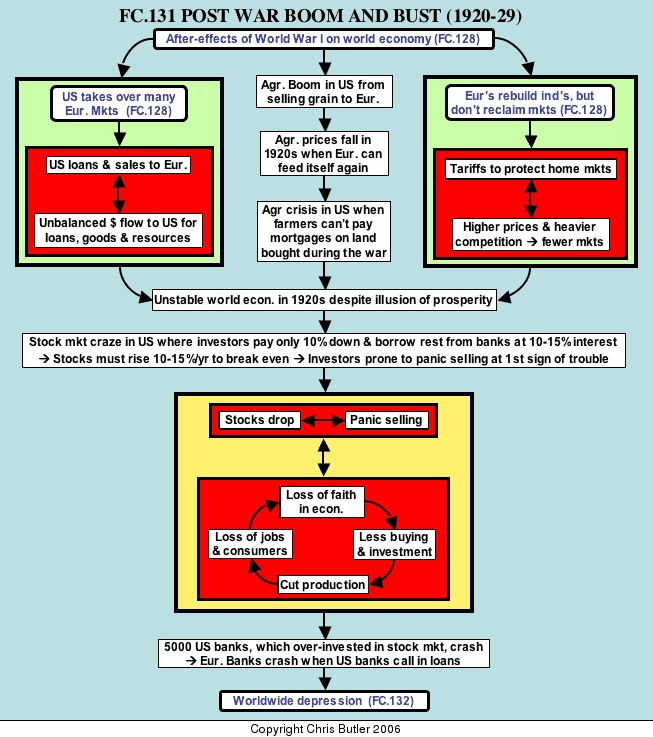

The 1920's have been popularly seen as a decade of political stability and economic prosperity. Indeed, Germany did settle down, and seemed to stabilize after 1923, new democracies were established in Eastern Europe, and prosperity did seem to return. A whole barrage of new technological breakthroughs and products signaled this: affordable mass-produced automobiles, vacuum cleaners, refrigerators, cellophane, radios, talking movies, and commercial air travel to name a few. But in reality, the 1920's presented largely an illusion of prosperity, for beneath the surface were three serious problems, all arising from World War I and undermining the stability of the world economy.

The first problem largely stemmed from the nature of American dominance of the world economy in the 1920's compared to previous British dominance in the 1800's. The British had maintained a fairly balanced cash flow in world trade since they had to buy raw materials with much of the money they made from selling manufactured goods. This prevented too severe a drain of cash from other countries, thus assuring Britain more stable markets. In contrast, the United States was not only an industrial power selling manufactured goods in markets it had claimed from Europe during the war; it also had its own vast natural resources. Therefore, little money had to leave the United States to buy the raw materials needed to manufacture its products. This created an unbalanced cash flow from the rest of the world to the United States. As a result, European nations, still recovering from the war, needed loans, which they got from American banks. This sent even more money to the United States in the form of repayments and interest, just making an even more unbalanced cash flow, and so on.

The second problem had to do with Europe's recovery from World War I. European industries did revive to their old pre-war levels of production by 1925, but they failed to reclaim their old markets from the United States or create new markets to compensate for the losses. As a result, the intense economic competition between nations that had largely caused World War I continued after it. Therefore, nations still maintained high tariffs, which raised prices, cut world trade, and further weakened the world economy.

Finally there was an agricultural crisis in the United States. This was the result of dramatic expansion of farmland in order to meet the food demands of the European countries during the war. However, European agricultural production revived after the war, causing overproduction. Grain prices plummeted, and American farmers went into debt, many of them losing their farms when they were unable to maintain mortgage payments on their newly expanded farms. Therefore, although America's industries seemed to be thriving, its agricultural sector, still a large part of its population and economy, was in trouble.

The Crash

Ironically, while all of these problems led to an unstable world economy, they also created an illusion of prosperity. This was especially true in the United States where investing in the stock market had become a virtual national sport. However, the American stock market in the 1920's had a fatal flaw, since investors only had to pay as little as 10% cash for their stocks. Banks financed the balance at 10-15% interest. This made it easy to buy stocks, so the stock market rose at an unprecedented rate in the late 1920's. But this also meant the market must rise 10-15% per year for investors to break even after accounting for their loans plus interest. This created an increasingly uneasy atmosphere as investors worried about how much the already inflated value of stocks could rise. For those realistic enough to pay attention, there were danger signs for the economy in the fall of 1929. In October, the market crashed.

Much of what happened was a classic case of panic psychology running wildly out of control. When some investors started selling stocks, this left other investors in debt to the banks nervous about stock prices falling, something they could not afford. Therefore, when some of them started selling, stock prices fell more, which caused more panic selling, even lower prices, and so on. In a matter of hours, millions of investors were ruined, with some stocks falling $75 per share. It got worse. By November 1, investors had lost $40 billion, and by November 13, the stock market had lost half of its value.

This spilled over into the rest of the American economy, causing an overall lack of faith in the future, which led to a decline in investment and buying. Therefore, production was cut, which cost workers their jobs, further undermining faith in the economy, and so on. This only hurt the stock market, which then fed back into the cycle of economic decline. By 1932, industrial production in the United States had fallen by half, national income by 75%, and the value of some stocks from $100 to $.50 per share. This led to the collapse of 5000 American banks, many of which had over-invested in the stock market. These banks called in loans from Europe, whose economies were already unstable and overly dependent on American loans. The result was a worldwide depression spreading from America and Europe to the rest of the world that was tied into their economies.